gift in kind donation

An individual donates 500 to a charity and in appreciation the donor receives two theatre tickets worth a combined value of 90 from the charity. In-kind donations are generally those of goods a direct payment for a bill or services.

How To Donate Your Valuables And Noncash Items

Gift-in-kind or GIK is a type of charitable giving in which contributions take the form of tangible goods rather than money whether that be supplies equipment and materials or services.

. It includes goods services time or professional services. While determining the fair value of cash and. An in-kind donation also known as a gift-in-kind is usually a specific non-cash asset that is contributed to a charitable organization for which the donor may receive a donation.

Physical or tangible gifts such as computers furniture office equipment software and clothes. If the gift is property the property must have been purchased 12 months or more before making the donation. In-kind donations for nonprofits refers to types of contributions that dont involve cash.

Since the standards for recognizing contributions at their fair value were issued in 1993 NFPs have been challenged to measure the value of the myriad contributions they receive. Donation can be made in cash or other than cash ie. This controversial area is once again being addressed by watchdog agencies and state attorneys general and thus is one that NFPs should navigate with care.

It can be tangible clothing books bicycles or. A gift-in-kind GIK is a donation that instead of involving money involves physical items. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits.

In broader terms in-kind donations also known as gift-in-kind are. An in-kind donation is a non-monetary gift of a product or service to a nonprofit from an individual a business or a corporation. How does the IRS or CRA know if you give a gift.

What in-kind donations are and are not eligible to be receipted. Naturally your In-Kind donation cannot be considered the same as cash relative to IRS regulations but any smart non-profit would recognize your In-Kind donation in the same way. They can include donations of land buildings marketable securities equipment.

1500 for contributions and. In-kind donations take on diverse forms. In-kind donations are non-financial gifts made to an organization.

A gift-in-kind is a voluntary transfer of property other than cash without consideration. The following calculations are used to. In-kind donations are valued in monetary terms and they should be recorded on a companys budget for a value equal to the value of in-kind gifts the non-profit organization receives.

Gifts in kind also referred to as in-kind donations is a kind of charitable giving in which instead of giving money to buy needed goods and services the goods and services. The letter should describe the item s donated but should not include a dollar value. CRA recommends a formal appraisal on in-kind donations valued over 1000.

Your gift or donation must be worth 2 or more. For example if you are an animal. In-kind gifts of tangible property are reportable on the organizations annual Form 990 under the category of gifts grants contributions or membership fees Certain types of gifts including.

It includes numerous types of property in particular inventory capital property and depreciable property. Donation in simple terms means help out of gratuitous terms. Through ChildFunds GIK program our corporate partners donate physical goods that are.

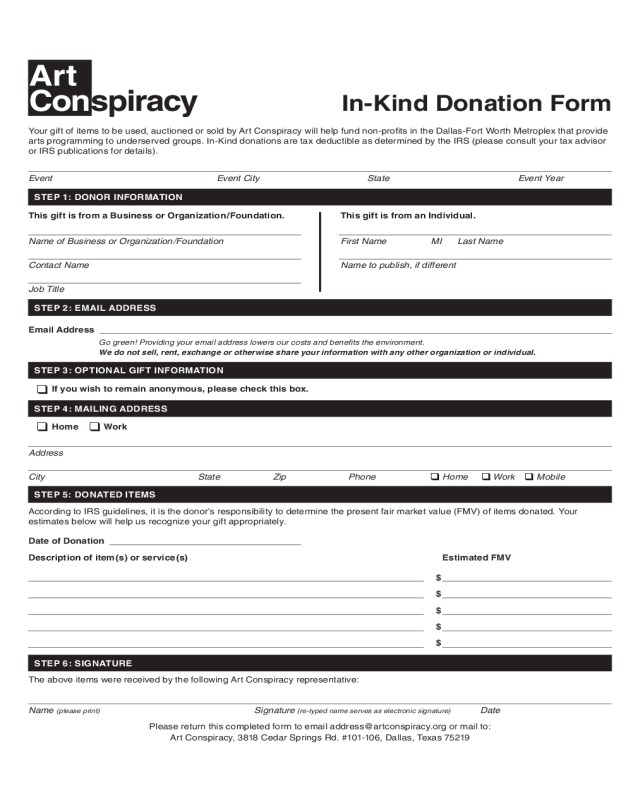

Gifts in-kind are donations of property other than cash. Download Gift in Kind Acknowledgement Letter Word Doc The letter serves as a thank you and required written acknowledgment and should include specific language from the downloadable template for tax purposes. The lifeblood for some sustainable nonprofit.

An in-kind donation is a non-cash gift made to a nonprofit organization including goods services time and expertise. Properly recording in-kind donations as.

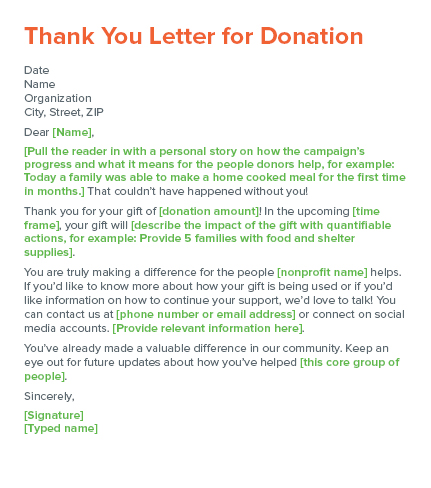

Donation Letters How To Write Them 3 Templates

In Kind Donations Accounting And Reporting For Nonprofits

Essentials Of In Kind Donations Instructor Name Course Date Ppt Download

In Kind Donation Receipt Template Printable Pdf Word

In Kind Donations Second Heart Homes

Your Complete Guide To In Kind Donations

Gifts In Kind Everything You Need To Know Project Hope

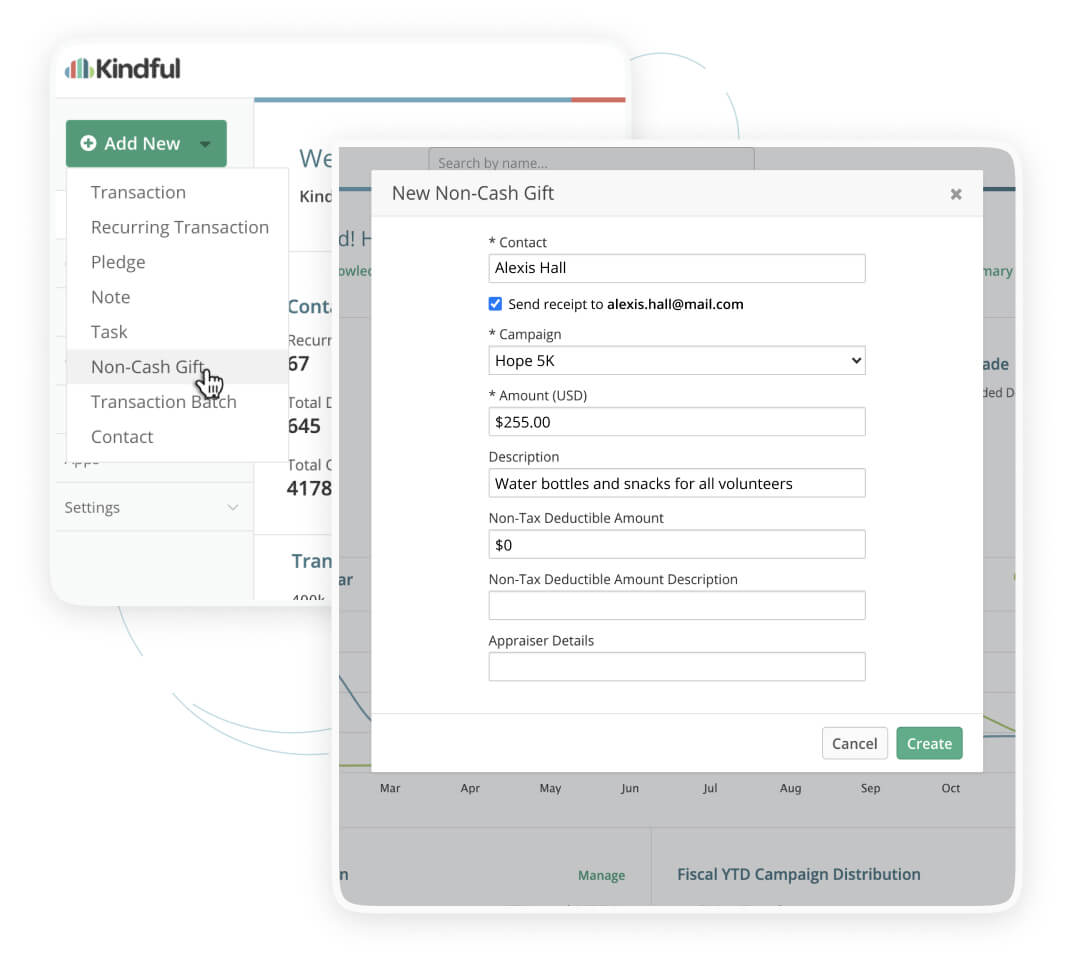

In Kind Gift Recording And Tracking Kindful Crm

In Kind Donation Form Orlando Science Center

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Letter Templates Receipt

Gift In Kind Arts Management Systems

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

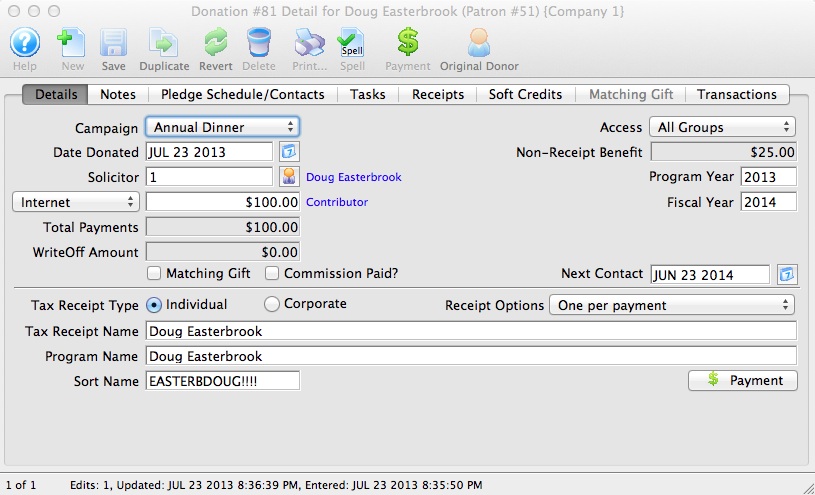

Receiving Recording And Processing Donations Populi Knowledge Base

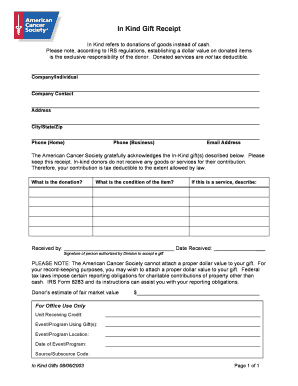

In Kind Gift Receipt Form Fill Out And Sign Printable Pdf Template Signnow

In Kind Donations Ywca Kitsap County

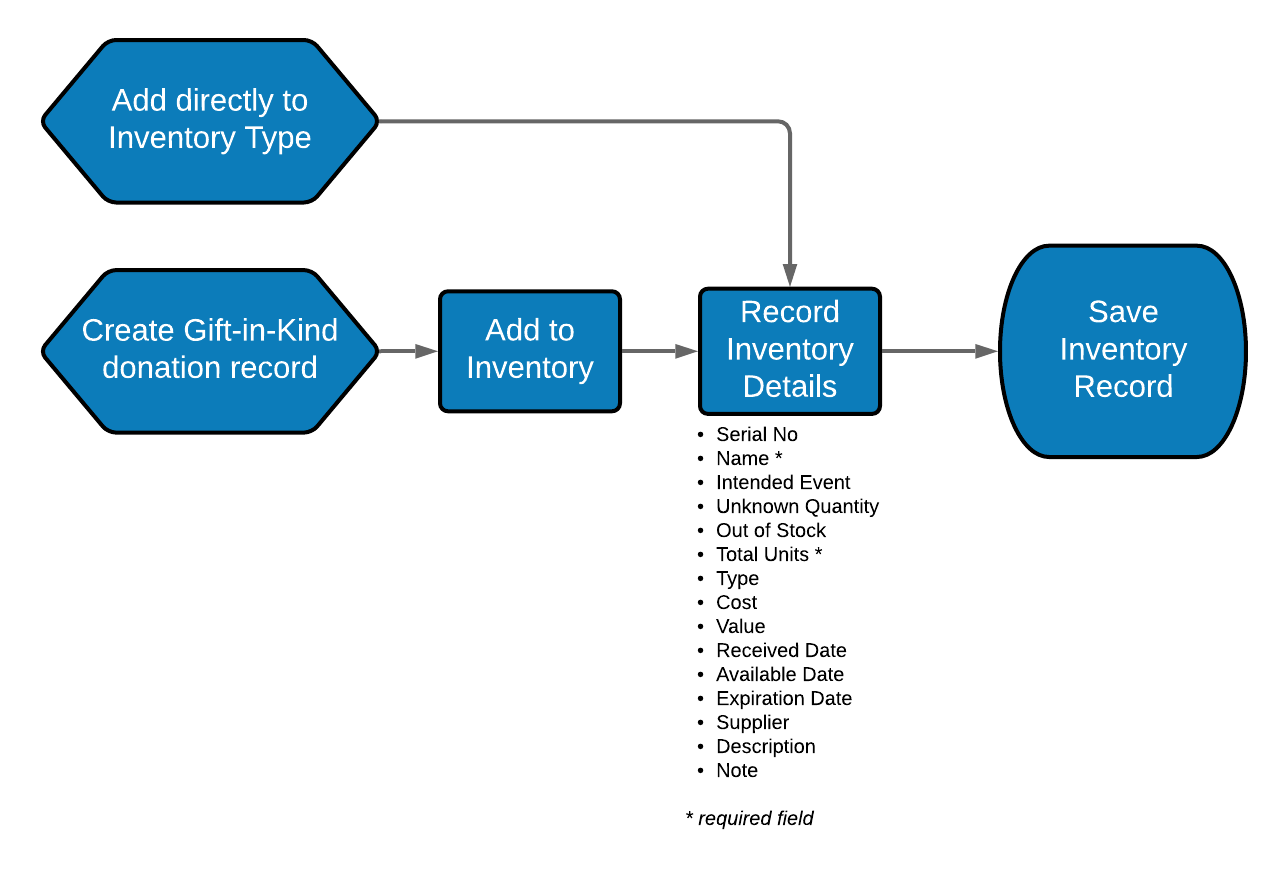

Add A Gift In Kind Donation To Inventory Salsa Knowledgebase

Accounting And Reporting For Stock Gift Donations To Nonprofits